When an incident occurs, policyholders face the "Insurance Claim" process. This often-complicated process highlights the need to adopt advanced technologies to provide customers with a smooth and efficient experience.

Author: Radu Mărgărit

Author: Radu Mărgărit

Whether it’s auto, property, or life insurance, when an unfortunate event happens, the policyholder will request compensation from the insurer based on their policy. This process, through which the insured notifies the insurer and the insurer takes all necessary steps until the policyholder receives compensation, is called the “Insurance Claim”. Many of us have gone through such a process and found it time-consuming, with the insurer requesting various documents, leaving you unsure of how long it will take or how many trips you’ll need to make to the post office or the insurer’s office. Let’s explore how new technologies can improve the process so that the end customer benefits from a better interaction experience with the insurance company.

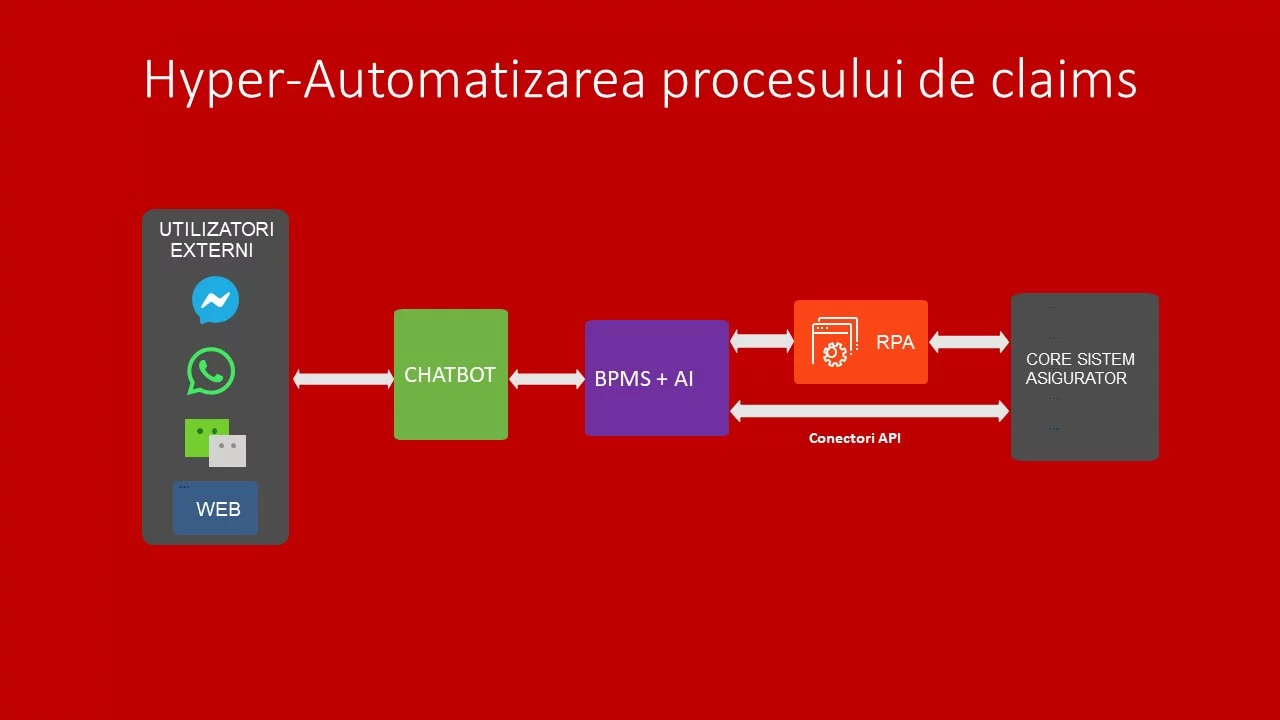

We can almost completely automate a claims process using three types of automation technologies embedded in a unique hyper-automation solution:

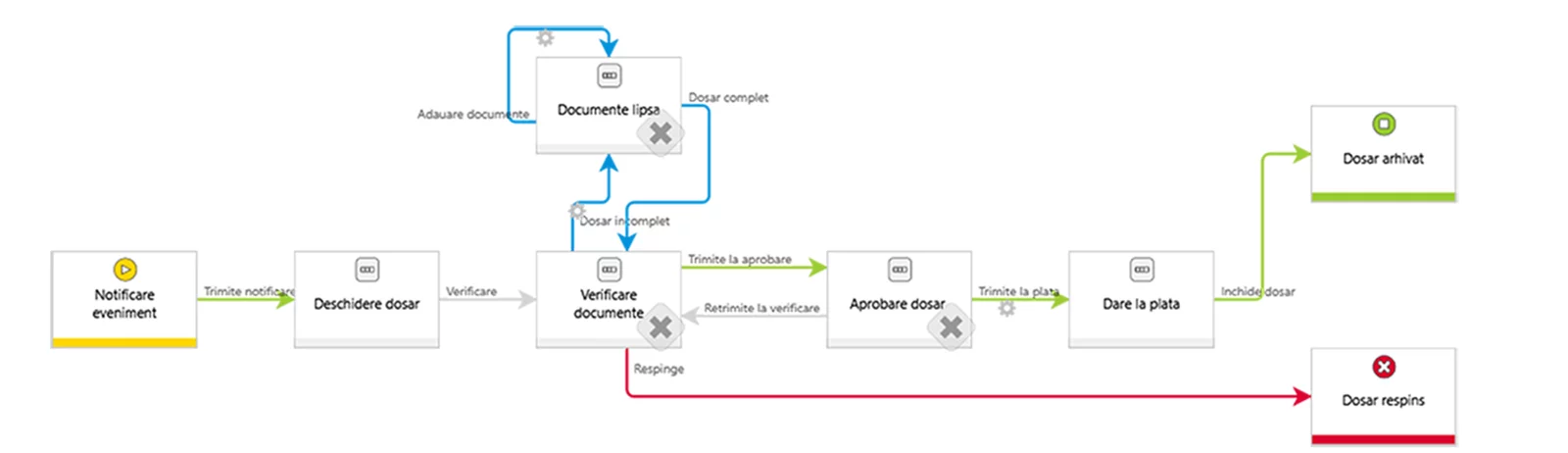

Event Notification – The first step in the claims process is the notification of the event by the insured. The insured goes to the insurer’s website, Facebook, or WhatsApp and initiates a conversation with an AI-powered chatbot capable of answering all their questions and guiding them in preparing the documents necessary to open the file.

File Opening – In the second step, the information collected and validated by the chatbot is automatically transmitted via API to the BPM platform. This platform initiates the opening of the claim file and, based on the information received, checks in the insurer’s internal systems to see if there are policies related to the insured, if they are active, and if they cover the reported event.

Document Verification – In this step, the BPM system notifies a specialist from the claims department that a new file has been assigned to them. The specialist checks the information and intervenes where necessary, requesting new documents or information from the insured.

File Completion – The chatbot contacts the insured via WhatsApp or Facebook Messenger, informs them of the additional documents required, and provides all the details for obtaining them. When the insured obtains the documents, they upload them from their phone or computer into the chatbot’s dialogue window, which transmits them to the BPM.

File Approval – The claims specialist validates the documents and sends them for approval to a superior. The superior can view and approve them from a laptop or mobile phone. Upon approval, the BPM system generates the payment report.

Payment Processing – An RPA robot processes the payment report in the payment system and other core internal systems. When the payment is successfully processed, the BPM system sends the payment information to the chatbot, which then notifies the client of the amount and account to which the transfer was made and requests feedback from the insured.

File Closure – In the final step of the process, the BPM system records the feedback collected by the chatbot, closes the file, and transfers the necessary data to other internal systems.